AI-Powered Guest

for Hospitality Pros

Boost revenue per guest, unify messaging, and let AI handle the heavy lifting for you and your team.

Automate guest checkin with the Boarding Pass.

Automate Guest Messaging

NEW

Track progress with To-Do, Follow-Up, and Resolved states. Snooze conversations for later and auto-archive them after checkout, so nothing’s missed and you can focus on what matters.

Track Guest Insights

Easily add private, in-line notes to guest conversations, visible only to your team. Plus, access a dedicated tab with every note saved for that guest in one place

Centralize All Channels

Connect with guests anywhere - OTAs, email, sms, WhatsApp - all from one place.

Automate and Scale

Automate messages, tasks and tagging to streamline operations. Let AI AutoPilot answer the repetitive stuff. Clearly outline what messages should send and when, throughout the entire guest journey.

Hear about cost benefits to automate guest messaging.

Insights & Reporting Dashboard

NEW

Track, analyze and manage your guest interactions in real time. Get valuable insights about your guest experience performance.

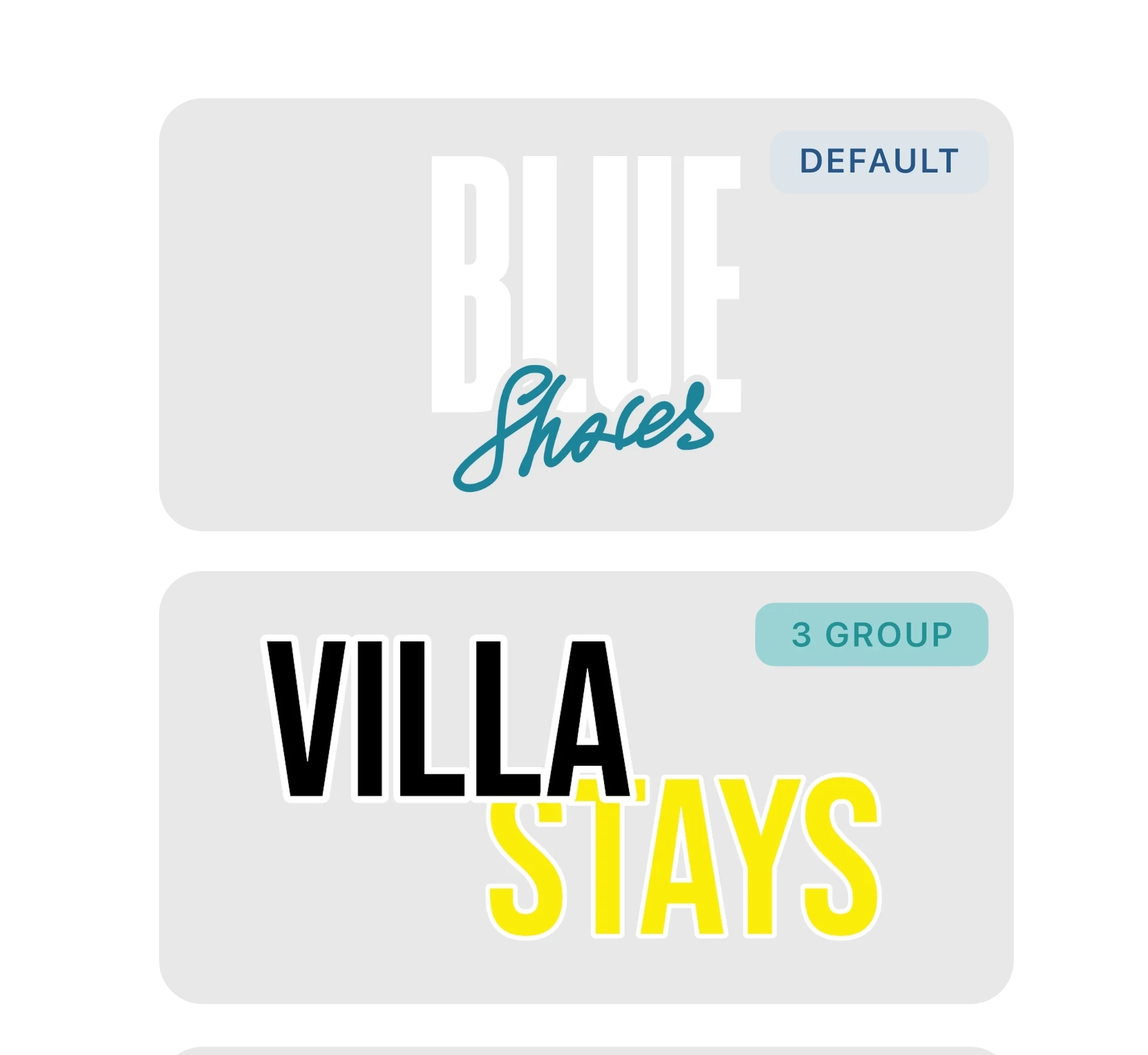

Multiple Brands

Manage multiple brands, run a franchise, use different PMS systems, or payment processors & centralize the guest experience in one platform.

Webhooks & Downloadable Data

Easily add private, in-line notes to guest conversations, visible only to your team. Plus, access a dedicated tab with every note saved for that guest in one place

CRM

Leverage your guest data to drive direct bookings and 5-star reviews with simple campaigns and powerful CRM features.

You don't need to hire more if you build smart guest automations.

ROI Guarantee

64

Days to ROI

20.5X

Cash ROI on Enso Connect

40hrs

less time per week spent on pre-arrival comms

Our partners & integrations

We seamlessly connect everything you need, from property management systems, to smart devices and experience partners, in one platform.

Get Pricing Now

Get tailored pricing for your business.

Our Impact at a Glance

Built for scale - empowering hospitality pros to grow revenue and elevate guest experiences globally.

Listings

50K+

Guest Processed

10M+

Countries

60+

Integrations

30+

Upsell Revenue Earned by Enso Pros

$35M+

Enso delivers fast ROI & pays for itself

Hear from Enso pros who see quick ROI, cover costs, and boost revenue

Learn how the Boarding Pass helps you create seamless guest journeys.