As a vacation rental property manager, understanding your property’s profitability is key to making informed decisions and maximizing returns. But with so many factors to consider – costs, revenue, occupancy rates, and more – it can feel overwhelming. We’ve got you covered. In this guide, we’ll break it down into simple, actionable steps to easily calculate and improve your short-term rentals’ profitability.

Why Profitability Matters for Vacation Rental Managers

Professional short-term rental managers who want to stand out and attract quality property owners must offer real value to customers. This means not only keeping properties well-maintained and safe but also ensuring their cash-on-cash return is maximized. Running a vacation rental business is challenging. Margins are tight, and property managers typically earn only 20% of rental revenue, primarily from the nightly rate. The best way to succeed is to constantly identify opportunities to increase owner returns and boost your business income. There are two ways to increase the profitability of vacation rental properties: cutting costs and increasing revenue. A third factor is optimizing occupancy, but ultimately, that also ties back to revenue growth. In this article, we will review both, focusing on driving annual revenue.

Let’s dive into the steps to calculate your vacation rental’s profitability.

Understanding Metrics for Evaluating Vacation Rental Profitability

There are three key financial metrics that hospitality professionals use to assess profitability.

- Rental Income. This represents the total income from renting out the properties. It includes nightly rates, cleaning fees, upsells, fees and add-on charges like pet fees or damage waivers.

- Occupancy Rate. This metric reflects how often your property is booked, in percentages of days in a month. It directly influences your rental income and is calculated by dividing the number of booked nights by the total available nights.

- Operating Costs. These include all expenses related to marketing, maintaining and managing rentals under your management. Common operational costs are labour, taxes, insurance, utilities, maintenance, and marketing efforts.

Step 1: Calculate Your Total Costs

The first step is to understand all the costs associated with your vacation rental. These fall into three main categories:

1. Fixed Costs

These are expenses you pay regularly, regardless of how often your property is booked. Examples include:

- Mortgage or loan payments (in the case of managing properties for rental owners, an STR business won’t have this).

- Property insurance

- Property taxes

- Your team salaries

2. Variable Costs

These costs fluctuate based on how often your property is rented. Examples include:

- Cleaning fees (per booking)

- Maintenance and repairs

- Utilities (electricity, water, internet)

3. Hidden Costs

Some costs can be overlooked but can significantly impact your profitability. For example:

- Marketing and listing fees (e.g., OTA online travel agencies’ commissions, like Airbnb or VRBO)

- Property damages

- Unexpected repairs or replacements

Step 2: Determine Your Revenue Streams

Next, calculate how much money your short-term rental properties generate. Revenue isn’t just about nightly rates – it includes all income streams related to your property.

1. Rental Income

This is the primary source of revenue for most vacation rentals. To calculate it:

- Determine your average nightly rate

- Multiply by the number of nights booked per month

2. Additional Income

Don’t forget about extra revenue streams, such as:

- Cleaning fees

- Pet fees

- Damage waivers

- Operational upsells – early check-in, late checkout, charges for amenities, like pool heating, equipment rentals, BBQ grills, etc.

- Experiential upsells – experiences or services, like guided tours, concert tickets, cooking classes, etc.

Pro Tip: Offering additional services, upsells or amenities can significantly boost your revenue. There are some common myths about upsells. For example: early check-ins and late checkouts are too complicated and are not worth the time spent on organizing. In this article, we’re busting this and other misconceptions about upsells that lead to missed revenue opportunities.

Pro tip: You can elevate your guests’ stays with local experiences without lifting a finger. Learn more about the new passive income tool for vacation rental operators.

Step 3: Measure Occupancy Rate

Your occupancy rate – the percentage of time your property is booked – plays a huge role in your profitability. Here’s how to calculate it:

Occupancy Rate Formula:

Occupancy Rate=(Number of Nights BookedTotal Available Nights)×100

Occupancy Rate=(Total Available NightsNumber of Nights Booked)×100

For example, if your property is booked for 21 nights in a 30-day month, your occupancy rate is 70%.

Why Occupancy Matters

A high occupancy rate means more revenue, but it also means higher variable costs (e.g., cleaning and maintenance). Balancing occupancy with pricing is key to maximizing profitability.

Pro tip: there are dynamic pricing and revenue management tools that help optimize pricing according to rental demand and other key factors. For example, tools like Price Labs, Beyond ow Wheelhouse.

Pro tip: Successful vacation rental managers maximize occupancy by blending short-, mid-, and long-term rentals. See the example of High Street Townhouse, an aparthotel in Manchester, that achieved 90% occupancy. Others adjust pricing during the low season, increasing occupancy while offsetting lower nightly rates with upsell revenue. Set the example of Heimby, who’s reducing the costs of student housing and increasing owners’ returns by 40%.

Step 4: Use Formulas to Calculate Profitability

Now that you know your costs, revenue, and occupancy rate, it’s time to calculate your profitability. Here are the key formulas you’ll need:

1. Gross Rental Income

Gross Rental Income=Nightly Rate×Number of Nights Booked

Gross Rental Income=Nightly Rate×Number of Nights Booked

2. Net Operating Income (NOI)

NOI=Gross Rental Income−Total Costs

NOI=Gross Rental Income−Total Costs

3. Cash Flow

Cash Flow=NOI−Debt Payments (if applicable)

Cash Flow=NOI−Debt Payments (if applicable)

4. Return on Investment (ROI)

ROI=(Annual ProfitTotal Investment)×100

ROI=(Total InvestmentAnnual Profit)×100

Pro Tip: Use these formulas regularly to track your property’s financial performance over time.

Step 5: Leverage Tools to Simplify the Process

Calculating profitability doesn’t have to be a manual, time-consuming task. Here are some tools to make it easier:

1. Property Management Software (PMS)

Platforms like Guesty or Hostaway can automate cost tracking, revenue analysis, and occupancy rate calculations.

2. Revenue Management Tools

Tools like Beyond Pricing or PriceLabs can help you optimize your nightly rates based on market demand.

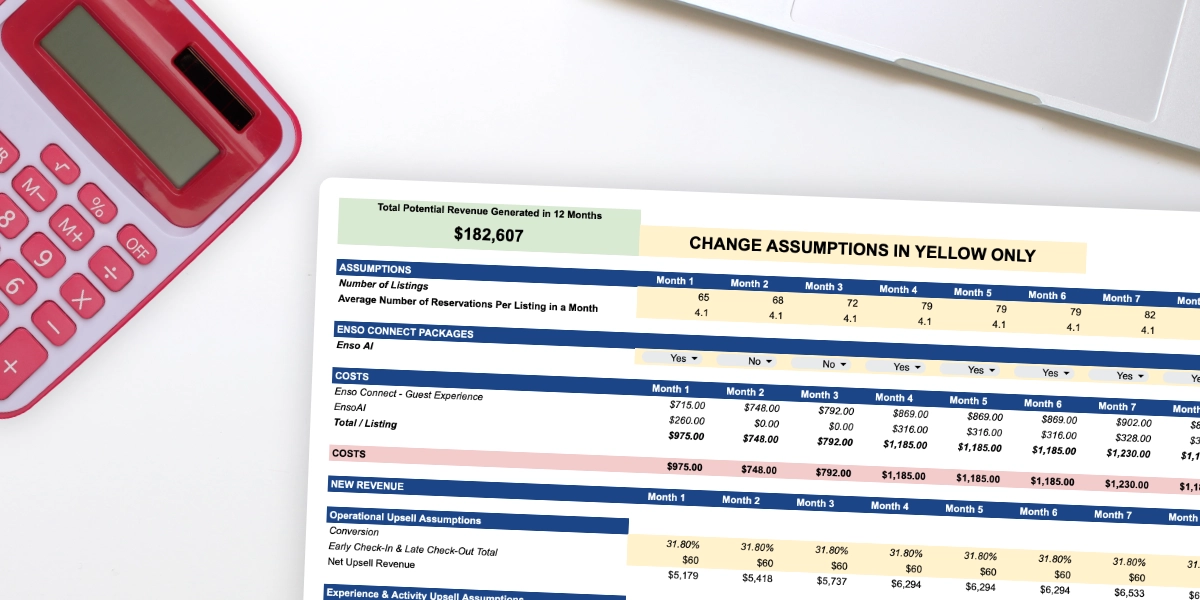

3. Rental Property Calculators

If you prefer the DIY approach, there are spreadsheets to track your costs, revenue, and profitability.

Use this rental income calculator to estimate the potential of your properties with upsells, fees and damage waivers.

Step 6: Analyze and Improve Your Profitability

Once you’ve calculated your profitability, it’s time to take action. Here are some tips to improve your numbers:

1. Reduce Costs

- Negotiate better rates with cleaning services or suppliers

- Switch to energy-efficient appliances to lower utility bills

- Streamline and automate repetitive tasks and processes to save your team’s time and reduce labour extra costs with operational efficiency.

- Add a direct booking website channel to reduce OTA fees and dependency on Airbnb, VRBO, Booking.com and other rental platforms.

2. Increase Revenue

- Offer additional amenities or services (e.g., airport transfers or grocery delivery)

- Adjust your pricing strategy based on seasonal demand

- Market your property effectively to attract more bookings

- Encourage your happy guests to leave positive reviews They can significantly impact your property’s reputation and booking rate.Pro tip: Automate your review requests with a custom workflow triggered by guest checkouts with positive sentiment.

3. Optimize Occupancy

- Use dynamic pricing tools to adjust rates based on demand

- Offer discounts for longer stays to reduce turnover

- Improve your listing’s appeal with high-quality photos, detailed descriptions and experiential offeringsLearn more about making your numbers add up in Vacation Rentals.

Real-Life Example: Calculating Profitability for a 2-Bedroom Vacation Rental

Let’s put it all together with a real-life example. Imagine you manage a 2-bedroom vacation rental in a popular tourist destination. Here’s how you might calculate its profitability:

1. Total Costs

- Fixed Costs: $1,500/month (labour, insurance, taxes)

- Variable Costs: $500/month (cleaning, maintenance, utilities)

- Hidden Costs: $200/month (guest damage, marketing)

- Total Monthly Costs: $2,200

2. Total Revenue

- Average nightly rate: $150

- Occupancy rate: 70% (21 nights booked per month)

- Monthly rental income: 150×21=150x21=3,150

- Additional income (cleaning fees, amenities): $200

- Total Monthly Revenue: $3,350

3. Profitability

- Monthly Profit: 3,350(Revenue)−3,350(Revenue)−2,200 (Costs) = $1,150

- Annual Profit: 1,150×12=1,150x12=13,800

This example shows how even a modestly priced rental can generate significant profit with proper management.

Learn about new ways to drive additional revenue in 2025.

Conclusion

Calculating your vacation rental’s profitability doesn’t have to be complicated. By tracking costs, maximizing revenue, and optimizing occupancy, you can create a profitable investment for your owners. Evaluating these key factors and implementing the revenue-generating strategies will help you maximize returns and ensure long-term success.

Ready to boost your profitability? Streamline operations and maximize revenue with AI-powered solutions by Enso Connect.