Rental arbitrage is one of the easier ways to get into the Short Term Rental market. In essence, Rental Arbitrage is the process of taking a Long Term Rental, and subletting it into several Short Term Rentals. There are several upsides and downsides to this model that make it appealing for some and risky for others. For starters, the company Sonders’ whole operation is based on the premise of rental arbitrage. But what does this mean?

Getting into the short term rental market

Rental arbitrage is an instance of getting into the Short Term Rental market without putting much “skin out there”. If you are someone with limited finances and cannot afford your own property, but are wanting to work in the Short Term Rental market, this may be your best option. The ability to take a Long Term Rental and turn it into your own Short Term Rental gives you the flexibility and ability to do so. However, the implications of fluctuating travel and rental occupancy may scare you away.

With the COVID-19 pandemic, many arbitrage businesses went belly up due to the fact that rental prices that were locked in were much higher than the revenues that could be received through Short Term Rental markets. As many people haven’t been able to travel, these Short Term accommodations have not seen their full potential, and the high locked in price can shut down many young property managers.

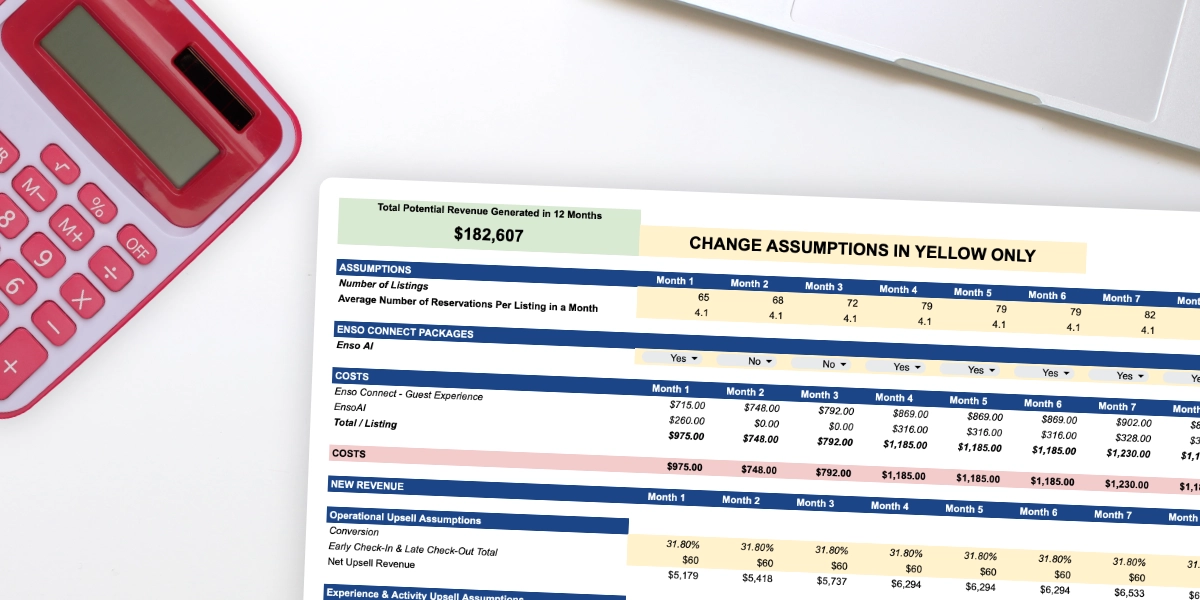

Where rental arbitrage can succeed is when the year long lease cost is less than the potential revenue generated by short term solutions. In a time like this, if you’re looking to make money, and currently have money, locking in a long term rental could be a good option. If you are okay with losing some money initially (due to lack of travel), you could lock in a property that has lower than average rent, but then leverage that for arbitrage later on as the pandemic restrictions fade.

Rental arbitrage in essence is a gamble. Like any other fluctuating market, you have to have some capital saved just in case your idea doesn’t go to plan. If you have capital and believe the pandemic restrictions will be over sooner than your landlord believes, then your current rent agreement may be a God send. Leveraging your current rental rate for the future for Short Term Rentals may mean a successful rental business.

At the end of the day, rental arbitrage may or may not be for you. If you have your own stories about arbitrage that you want to share, please email contact@ensoconnect.com to have them shared. If you have any questions, you can also email us, and we will try to give our best opinion on your situation.